If you’re looking to safeguard your company plus operate with increased flexibility and adaptability, forming an LLC in the state of Texas is a good move. The procedure isn’t as complicated as it look, but you’ll need to adhere to a some key procedures to stay legal and smooth. From choosing your company’s name to filing documents, each action serves a vital part—so before you start, there’s an essential point to think about.

Want to protect your business and gain flexibility? Forming an LLC in Texas is a smart choice. While it’s not overly complex, you need to complete important actions to stay within compliance and run smoothly. Beginning with picking your name to submitting forms, each action is important—here’s what to follow first.

Naming Your Texas Business

Before you register, it’s necessary to select a unique name that complies with Texas state regulations.

Start by the online database of the Texas Secretary of State to verify name availability. Your LLC name must include “Limited Liability Company,” “LLC,” or “L.L.C.”

Avoid words that could be confused with government departments such as “bank” or “treasury.”

Avoid using restricted words unless specific authorization.

After choosing your name, consider reserving it to protect it while you complete your formation documents.

Appoint a Registered Agent

Every Texas LLCs must name a registered agent to receive legal documents and official notices on behalf of the business.

The agent must have a physical location click here in Texas—P.O. boxes won’t do.

It’s possible to act as your own agent, hire a professional service, or designate someone you trust.

Make sure your the person or service is dependable during the normal working hours to accept attachments and notices. Reliability is key to staying compliant.

How to Legally Establish Your Texas LLC

In order to legally form your Texas LLC, submit the Form 205 with the Texas Secretary of State.

You can do this online or by mail.

The form requires your LLC’s name, address, registered agent info, and management structure.

Double-check all details carefully; mistakes can cause delays.

The $300, payable by credit card or online payment methods.

Once approved, this submission forms your LLC in Texas, giving you legal recognition and the ability to operate legally.

Create an Operating Agreement

Even though Texas not required an LLC to have an operating agreement, this document is a wise move to set ownership roles, profit sharing, and responsibilities.

It also helps in preventing disputes among members and clarifies procedures for matters like voting and management.

Even if you’re a single-member LLC, creating an operating agreement provides legitimacy and additional legal protection.

You may use a template or write your own tailored document, and all members endorse it to confirm each member’s responsibilities.

Handling Tax IDs and Licensing

Next filing your LLC, you need to obtain an Employer Identification Number from the IRS—this is cost-free and needed for tax purposes, especially you don’t plan to hire employees.

Review whether yourindustry needs state or local licenses or permits, based on your activities.

Also, submit mandatory Texas Franchise Tax Public Information Report to maintain your LLC’s good standing and prevent penalties.

Final Tips

Starting your Texas LLC is easy by following these steps: Choose a unique name, appoint a reliable registered agent, file formation documents, draft an operating agreement, and register your EIN. Stay up with ongoing state requirements like annual reports and licenses to maintain a compliant, thriving business in Texas.

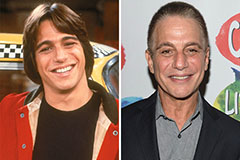

Tony Danza Then & Now!

Tony Danza Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!